S&W Board will set millage October 18, others to come

With the 2024 property tax rolls certified to the Orleans Parish Board of Review Friday, September 29, the next step in determining ad valorem tax liability for New Orleans property owners lies with the tax recipient agencies, announced Orleans Parish Assessor Erroll Williams.

Once every four years parish assessors must reassess all properties in their jurisdiction to reflect current market values. This “quadrennial” reassessment for Orleans Parish was completed this August for tax year 2024. All assessments are based upon values as of January 1, 2023.

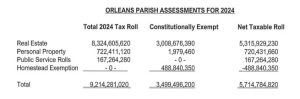

The current figures for the 2024 tax year are as follows:

These numbers will be changed later this month when the Orleans Parish Board of Review (City Council) votes to approve the value changes recommended by their consultants.

Currently, this is a 20 percent total assessment increase from the 2023 tax year, down from the 23 percent increase projected when the open rolls process began. This means tax recipient agencies must reduce their millage (tax) rate by 20 percent to keep 2024 revenues the same as 2023.

“The fate of New Orleans’ 2024 property tax rate, and how much people will have to pay, is now squarely on the shoulders of the City Council, School Board, Sewerage and Water Board, Sheriff, and other taxing authorities,” said Assessor Williams. “To our knowledge, the only citywide levying authority to schedule a hearing to increase its millage rate so far is the Sewerage and Water Board. Others have not published a notice as of today. We strongly encourage property owners to be watchful because their decision to raise millage rates will increase your tax bill.”

Please note that to raise the millage rates after the automatic reduction, taxing authorities must:

- Publish two separate notices in public journals announcing their consideration of a millage at a public hearing at least 30 days in advance of the meeting;

- Hold an advertised, open, and public hearing to consider their vote to increase taxes; and

- Approve the tax increase with a 2/3 supermajority vote of members.

The Sewerage and Water Board has scheduled its meeting to increase their millage rate for 9 a.m., Wednesday, October 18, 2023, at 625 St. Joseph St, Room #240.

The Orleans Parish Assessor’s Office will provide updates about all other taxing authority meetings to consider a millage increase as details are made available at www.nolaassessor.com.

“The required millage roll back is there to protect property owners from the inflationary value of their property, so it is important that the people are engaged, and their voices are heard,” said Assessor Williams. “Orleans Parish taxpayers don’t have to pay more because real estate market values went up.”

Click here for Taxing Authority 2024 Milage Breakdown as of October 10, 2023